University of web

In response to popular non-existent demand, we are publishing the most rigorous class that we require all first-year PhD students to briefly skim: Introduction to web3.

Of course, remember that I founded this institution with the goals of:

- fomenting resentment against web3

- perpetuating Big Tech, who rewards me handsomely with tungsten cubes to criticize any perceived threat to their continued dominance

- doing well for a college course, which is what this is all actually for

TL;DR: web3 is overhyped, inefficient, and dangerous.

Why is it called web3?

web1.0

Archaeologists specializing in the prehistoric times of the 1990s agree that the World Wide Web began as universities and nerds hosting their own websites and mailservers. Despite the simplicity of this early version of the internet, many of the infrastructural components of the modern web were developed and iterated in a familiar alphabet soup: DNS, HTML, CSS, HTTP, etc.

web2.0

Then we saw the emergence of tech companies that offered to ease the burden of having to run your own services. These companies would make it easy to connect with others and generate content for the world to see. You wouldn’t have to host your own website or mailserver anymore. You could just worry about producing content, and not the underlying infrastructure that was becoming increasingly complex as the internet was expanding.

In our current web2.0 era, we saw the rise of Facebook, Google, Instagram, Twitter, Reddit, Discord, WeChat, and so on. These platforms helped to faciliate an explosion in the internet’s global adoption. The user experience of communicating with others and finding information online was a lot easier and faster. The internet was no longer a niche thing.

Though these services have made our lives convenient, a lot of internet activity is now taking place under a few tech conglomerates. This has fueled concerns over privacy, censorship, and user autonomy.

web3

web3 is a proposed set of technologies — largely centered around cryptocurrencies and the applications of crypto — that will define the next generation of the internet. In response to centralization of the internet that occurred under web2.0, proponents of web3 argue that a new internet built on immutable blockchain technology will improve privacy, avoid censorship, and create new economic opportunities.

web3 isn’t magic. It is merely a bundle of blockchain technologies working together so you can buy cryptocurrency. Nestled between two industries notoriously vulnerable to hype, crypto’s positioning at the center of finance and computer science can easily confound and disorient even the most technically-adept. So to fully explore the risks of web3, we need to start from the beginning.

Is it effective?

Bitcoin

Bitcoin was published in 2009 by the pseudonymous Satoshi Nakamoto, whose real identity remains the subject of speculation.

CAUTION – The following content distills a very technical topic

The basis of cryptocurrency is that the individual’s digital wallet is a kind of one-man show. You don’t need a banking apparatus to transact your crypto because each digital wallet has a unique address associated with it. You may have heard that crypto is like a digitized form of cash, which is a fairly appropriate way to describe it.

But unlike cash, crypto’s decentralized nature makes it resistant to inflation and intentional devaluation because it has no intrinsic governing body.

Decentralization is a buzzword that we’ll return to several times. In this context, decentralization refers to the lack of control any singular entity is supposed to have over the cryptocurrency as a whole. Whereas you’re probably familiar with the notion of a central bank dictating monetary policy – i.e., the US dollar and the Federal Reserve – crypto has no de jure authority.

Proof-of-work

Though promising as described above, Bitcoin has fallen way short of its ambitions. Bitcoin relies upon a mechanism called “proof-of-work” to validate new nodes of transaction data added to the blockchain.

A blockchain is a digital ledger that cannot be edited once it is recorded. The Wikipedia page on blockchains is a good place to learn more.

This is a very computationally intensive process, which is to say that it requires an enormous amount of computing power. Bitcoin was designed to become more computationally intensive depending on the total computing power of the network. This was supposed to prevent a single actor from amassing a huge number of resources to dominate the blockchain, which is called a 51% attack.

a 51% attack is defined as a group of blockchain miners controlling the majority of the computing power available to the blockchain, and is therefore able to manipulate the blockchain. Imagine if a massive bunch of rogue voters decided to write-in their own candidate during an election, bypassing the typical party system.

So as the number of eager Bitcoin miners swelled in the past decade, the efficiency of the network plummeted. But as it turns out, these diminished returns are still marginally profitable, which makes mining exclusively favorable to miners who are willing to spend money on power-hungry mining rigs. Bitcoin alone consumes roughly the same amount of electricity as Argentina1, a country of over 45 million people.

The decentralized nature of Bitcoin paralyzes any attempt to improve the protocol. Imagine trying to change the way email works or switching the United States to the metric system; these endeavors are defeated by the inflexibility of the problem. Countless developers have attempted to “fork” the source code for Bitcoin and develop their own cryptocurrency to solve Bitcoin’s perceived flaws. Few of these offshoots have become successful, and most are generally indistinguishable from each other since creating a cryptocurrency is relatively trivial given the open-source nature of the field.

In fact, the issues plaguing Bitcoin are so endemic that within the crypto community, it is often regarded as inferior to other supposedly better currencies. Despite its poor reputation, Bitcoin remains one of the most popular crypto currencies because its skyrocketing price and notoriety in recent years makes it an attractive investment to many newcomers, who are inundated with advertisements to “invest in crypto today!”

Ethereum

Ethereum is tapped to become the next big cryptocurrency superseding Bitcoin. Its blockchain is more versatile than that of Bitcoin’s, with the ability to handle and store arbitrary data beyond Ethereum transactions alone.

To this effect, people envision Ethereum being capable of being far more than a mere currency. In theory, it could store legal records and medical histories, although glaring complications make this far from trivial. Ethereum also advertises a consensus mechanism that would not require the insane power demands of Bitcoin: proof-of-stake.

Proof-of-stake

Proof-of-stake is an alternative to proof-of-work whereby agents are issued transactions to validate depending on how much cryptocurrency they hold. Ethereum requires prospective validators to hold a measly 32 ETH to be eligible for this scheme. If you wanted to purchase 32 ETH sometime in the last year with fiat currency, it would have costed you a figure somewhere between $55,000 and $155,000 depending on your (un)lucky timing.

Despite proof-of-stake being designed to supposedly thwart the risk of a malicious actor by requiring that potential validators post some amount of collateral, this creates a system whereby only the most early adopters or wealthy individuals have the ability to participate in proof-of-stake. Given the typical American household has approximately $5,300 in savings,2 it is rare that a normal person just getting interested in crypto today can participate in proof-of-stake by idly investing money they likely don’t even have in a volatile, alien currency and running servers capable of handling Ethereum transactions. The odds are likely even less if we discard the assumption that our Ethereum dilettante isn’t from an developed economy.

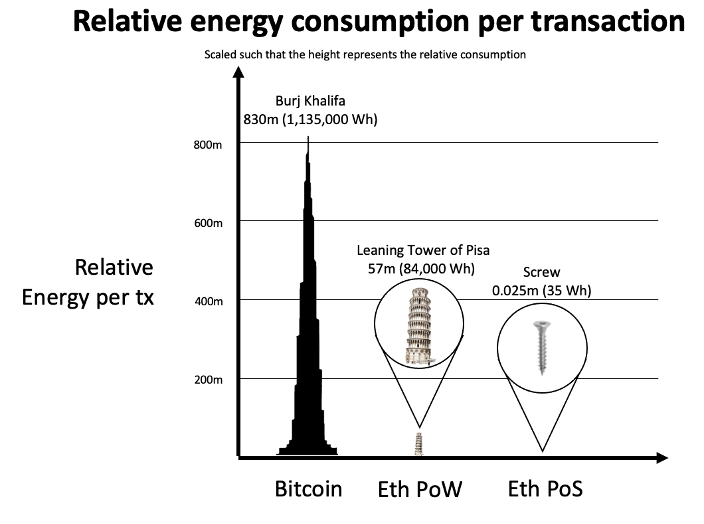

And while proof-of-stake is an order of magnitude more power efficient than proof-of-work, proof-of-stake still has an enormous energy demand. It also remains incredibly slow compared to established transaction systems, and inches Ethereum towards a level of centralization that cryptocurrencies ostensibly try to avoid.

Transaction fees

Cryptocurrency transactions require immense computing power to validate transaction data. To solve this, Bitcoin and Ethereum operate an auction system whereby users pay miners fees to process their transactions as quickly as possible.

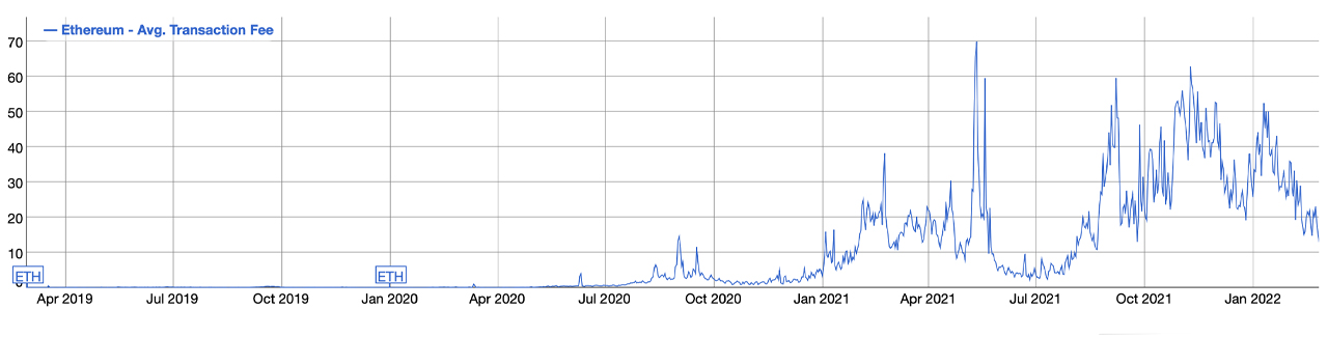

Let’s look in particular at Ethereum, which has exploded in popularity in the past few years. These fees, commonly known as “gas fees” within the Ethereum user base, have ranged sharply over the past few months:

The more people trying to transact, the higher the fees become; a mechanism analogous to surge pricing on apps such as Uber or Lyft. These transaction fees make it implausible that mainstream crypto will be used to buy and sell goods and services, as they were originally intended. But unlike Uber and Lyft, ‘surge pricing’ is not a local event, and extends universally to the entire protocol. Imagine paying a higher ‘cryptocurrency processing fee’ at a local restaurant because people in a neighboring country are rushing to preorder movie tickets online.

Paradox of centralization

One of the most popularly cited advantages of web3 is decentralization.

Decentralization in this case is the idea that the internet of the future will no longer be controlled by a handful of technology conglomerates that regulate and/or censor content

If the internet was ‘decentralized,’ we would not have to worry about censorship. If we were to embed blockchain technology into the core of the internet, centralized power structures should eventually decay. But why exactly would this happen? It’s grandiose mental gymnastics.

Centralization emerges in free markets because of economies of scale. And especially when Bitcoin and Ethereum have such high barriers to entry, the catalysts of centralization are even more apparent. Despite the hype surrounding decentralization, the cogs of web3 are ironically deeply centralized.3 We have:

- Coinbase for trading and exchanging cryptocurrencies (89 million registered users)

Un-fun fact: Mt. Gox used to handle upwards of 70% of all Bitcoin transactions in 2014. Then it suddenly shut down after people discovered that customers’ Bitcoins in Mt. Gox’s wallet had been systematically stolen and mismanaged for years.

- OpenSea for trading NFTs

- Metamask for Ethereum-based authentication

- and company X to achieve basic function Y, etc.

And most tragically, the blockchain is often so inefficient at scale that these organizations rely upon ordinary, boring technologies like SQL databases and C++ to handle transactions and user data.

And where do these databases and code exist? On centralized computing resources like Amazon Web Services or Microsoft Azure.

There are some genuinely effective implementations of a decentralized architecture. Folding@home, which uses volunteer computing power to simulate protein folding for medical research, is one of them. So is the Tor relay network, which enables millions of people to navigate the internet with anonymity and to evade heavy-handed electronic surveillance. Torrenting is an especially powerful example, because people attaining the contents of the torrent are simultaneously enabling that content to spread more easily.

Renewable energy whataboutism

Mining cryptocurrencies and validating blockchains consume an enormous amount of energy because their decentralized architecture demands a lot of redundant computational work. Crypto advocates defend cryptocurrency with two general stratagems:

Crypto is only as dirty as the energy it relies upon.

This argument ignores the immense electronics waste that crypto generates — mining rigs are often several thousand dollars and consist of several high-end graphic cards originally designed for gaming. But more importantly, this argument shifts the blame of crypto’s wasted energy usage onto the world’s failure to adopt renewable energy. But cryptocurrencies do not accelerate the world’s shift to renewables, they instead delay it.The energy that goes into powering the Ethereum or Bitcoin network could have been used to power electric buses, tea kettles, and LED lightbulbs.4 In this sense, cryptocurrency is nullifying the effect of renewable energy, because it uses electrical capacity that could have gone to a far more productive cause. Granted, transaction speed and energy usage are loosely related, but the mere existence of a blockchain fundamentally demands energy.

If the cost of electricity drops due to cheaper solar, wind, or nuclear power becoming readily available, then miners would simply scale up their activity in response. This is a classical demonstration of induced demand — the phenomenon where increased supply prompts increased demand. A city widens their highway (which takes great cost and time) to fight congestion; traffic instead increases to match the capacity of the road and congestion remains an issue. Eli Whitney thought his cotton gin would eliminate the need for slaves; instead, it made enslaved cotton production so efficient that plantations bought considerably more slaves to accomodate the throughput of the cotton gin.

The global banking industry consumes way more energy than crypto.

People have different ideas of what the global banking industry is because the term itself is ambiguous. Is the global banking industry simply a collection of the largest banks, their subsidiaries, and payment processors such as Visa and Mastercard? Does it include the greater institutions that support the global banking industry, such as various national governments and the companies responsible for building millions of cash registers and payment keypads? Would it include the safeguards of international financial stability, such as the US military?

The goalposts of this debate constantly shift and blur any attempt to answer the question of whether crypto or the global banking system is more efficient. If we were to adopt this whataboutism in the opposite direction, we can argue that crypto itself is complicit in the emissions of semiconductor manufacturers and rare-earth metal mining companies that provide the components and raw materials ultimately used to build mining rigs.

What we do observe with certainty is that the gritty global banking system that the world relies on today provides financial services for nearly eight billion people transacting trillions of dollars per day. If crypto were to support the same global audience at its present stage of development, it’s doubtful that this system would be much more sustainable at scale.

Crypto to the rescue of crypto?

As we have seen, there are a bunch of fundamental mechanical problems with cryptocurrencies, whether they use proof-of-work or proof-of-stake. They spawn stratified power structures that are deeply antithetical to the spirit of the movement that promotes them.

Because cryptocurrencies are open source, we have seen countless instances of developers forking a cryptocurrency and building their own implementation. This is especially easy when a nicely typeset \(\LaTeX\) whitepaper is all you need to appear legitimate to gullible early adopters. The barriers to entry for a new cryptocurrency are so low that these derivative coins are often called shitcoins.

But beyond those who are purely motivated by amusement or the hope of ‘getting rich quick,’ there are some developers who are working on hard-fought efforts to address the fundamental issues of cryptocurrencies and decentralized consensus protocols. You might hear of these technologies and movements – radix, sharding, DAOs, DeFi, layer 2.

Here at the University of web3, we have decided to take a simple approach to these proposed technologies and ask ourselves: what problem are they truly solving? Is it too easy to confuse imitation for innovation, because many of these newer technologies ultimately only help catch crypto up to the performance and centralization of our established financial system?

For instance, Ethereum proudly advertises that it will reduce its energy consumption by 99.95% once it fully adopts proof-of-stake. But as we have seen, proof-of-stake is a trade-off that further increases the centralization and barriers-to-entry of the Ethereum network.

Is it safe?

web3 is built on technologies that are saturated with scams and fraud.

Case study: non-fungible tokens (NFTs)

In 2021, non-fungible tokens emerged as the keystone in a series of unfortunate events. A mechanism intended to somehow introduce scarcity to digital objects, NFTs bewilder any rational attempt to decipher their purpose. Non-fungible essentially means “non-substitutable” or “non-replicable”, and in this case means stamping unique serial numbers onto tokens hosted on the Ethereum blockchain.

But this sense of uniqueness is completely lost upon the implementation of NFTs, which are little more than URLs pointing to an image file. If the URLs eventually no longer point to the artwork, then the NFT becomes an empty carcass since the blockchain can’t be retroactively edited. This implication of perpetual storage is a daunting responsibility to maintain, but we have already seen centralized services like NFT.STORAGE gladly advertise perpetual storage with no warning asterisks.

The NFTs themselves are stored on “Filecoin storage providers,” which are basically just organizations with lots of hard drive server space who are hosting NFTs so long as they receive an appropriate return on investment. Becoming a Filecoin storage provider isn’t a trivial matter of installing some ordinary open-source software, it requires getting in touch with a sales team and building a power-hungry server, which again is antithetical to the whole “democratization of art” part of the NFT verbiage. From the Filecoin provider documentation, you’ll need:

- 8+ core CPU

- >128 gigabytes of RAM

- one of these GPUs

- a terabyte of NVMe-based SSD storage for caching

- …and some other hard drives to serve as your actual server storage

The CPU, RAM, GPU, and drives each cost more than a PlayStation 5.5 And this doesn’t begin to consider the cost of powering a +400 watt server6 that probably demands a faster internet connection than the one in a typical home.

Those who can realistically afford and operate this kind of hardware belong to a technical minority, and their only incentive to hold your NFTs safely is their estimated return on investment.

So now that we’ve addressed the worrying infrastructure of NFTs, let’s get back to the user side of things. Though the interface and user experience of NFT auction houses like OpenSea resemble that of an art auction, they are even more unscrupulous. Since cryptocurrency wallets are largely anonymous and at least pseudonymous,7 let’s see how we can synthesize some demand for a masterpiece in seven steps.

- Alice, attracted to the NFT hype and possessing no artistic talent, mints an NFT for her ugly or stolen creation.

- Alice publishes a page on OpenSea.

- Alice observes no demand for her artwork.

- Alice buys more Ethereum and deposits it into newly spawned wallets.

- Alice uses her fresh wallets to bid on her worthless artwork and create the illusion of urgency and demand.8

- Bob sees rapid interest and gets duped into buying Alice’s artwork.

- Alice collects her profits. If Bob was swayed into buying the NFT, then Alice’s crypto would have gone back into her original wallet anyway.

The big problem here is that both Alice and Bob need to spend their legitimate money to conduct this whole seven-act tragedy. The cost of minting the NFT is a volatile figure, but there are artists who have incurred net losses of several hundred dollars in various fees9 from minting their NFTs (which sometimes are merely stolen or lightly edited artwork). Meanwhile, they have provided upward pressure on the ETH:USD exchange rate and liquidity to cryptocurrency traders by having to buy Ethereum.

Case study: rubber-hose cryptanalysis

A bank offers many protections for its customers. If somebody steals your credit card, you can contact your bank’s fraud department to scrub the charges and you won’t have to pay anything. If your bank fails and you live in the United States, the federal government guarantees your savings are secure.

“But wait! Consumer protections that guard against bank failure are an irrelevant counterargument against cryptocurrency’s safety, because cryptocurrencies operate without any need for banks! Why would you need to be protected from a bank robbery, if bank robbery can’t happen with crypto?”

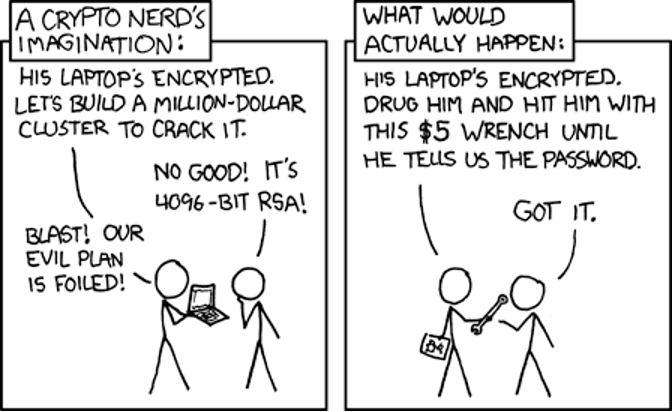

But in the cryptocurrency world, you are your own bank. There is nothing protecting you from poor memory, scammers, hackers, or people who are willing to beat you with a rubber hose and coerce you into revealing your wallet’s key.

In fact, it is this complete lack of protection that forms the basis of why people created banks in the first place — so that their money could be safely kept away from them in a more secure location.

If you put your account’s seed phrase on a flash drive and then forgot where that flash drive was, you’re SOL. There are horror stories of people who bought Bitcoin ten years ago, became millionaires unexpectedly, but are locked out of their newfound wealth because they can’t remember the decryption key to their hard drive, or they lost the storage device containing their wallet.

Cryptocurrency transactions are not reversible. There isn’t any mechanism to revert a charge that you were misled into approving. This is one of the largest reasons why so many scams are conducted with cryptocurrency, because there is no law enforcement agency that can effectively halt a transaction or reverse it.

Is it wanted?

At best, web3 developers have noble, if grandiose, motivations to improve financial equity or the freedom of the internet. At worst, it seems that web3 is nothing more than trying to lure normal people to buy cryptocurrency. This is the catch: by entering the web3 space, you provide liquidity to the Bitcoin and Ethereum market. As a striking figure, consider that users spent about $100 million in Ethereum gas fees to buy $200m in Bored Ape NFTs.10

The incentives in the web3 space are far removed from actually improving the quality of life issues we’ve seen with web2.0. As the price of Bitcoin and Ethereum has shot up by orders of magnitude in the last five years, we have seen countless news stories of random people who have become billionaires when considering their crypto net worth. The issue is that there are not enough buyers for these individuals to actually liquidate their holdings into a usable state of, say, US dollars.11

And this newfound wealth is tied to a highly speculative price. A price that is entirely contrived, and is tied to a currency that you cannot really use in a purposeful day-to-day manner.

As such, the “whales” need somebody to buy into the crypto-hype, so they can wind their position down.

a whale is a large holder of cryptocurrency who can manipulate a coin’s valuation through their sheer size

This has been historically termed the “greater fool theory.” To stimulate demand for cryptocurrency, these bagholders need to create means for ordinary people to get involved. If you are particularly cynical, you can interpret the goals of NFTs in such a way.

The greater fool theory posits that an already inflated asset can be resold at an even higher price, and generate profits for the original holder of said asset

Remember the January 2021 GameStop fiasco? If you peer into the r/wallstreetbets threads, you’ll find countless users exhorting their fellow witless GME shareholders to “hold the line” and not sell their shares. All the while, those same users were quietly exiting their position and selling their shares to the next fool on the chopping block, such as the founder of University of web3.

So what’s next?

The issue with web3, NFTs, or cryptocurrencies is that they fall way short of achieving their stated objectives. Cryptocurrencies are unable to solve the problems of the banking industry, web3 is unable to solve the problems of the tech industry, NFTs are unable to solve the problems of the art industry. This is because each of these industries suffers from dark patterns of human behavior, and web3 is not immune to such behavior. web3 does not prevent bad actors from exploiting and misleading others.

The technologies surrounding web3 are instruments of human naivete and opportunism. Because of wild speculation and FOMO on behalf of venture capitalists eager to take a measured bet on such audacious claims, we have seen web3 startups explode in valuation despite delivering little value. Browse some of the technologies listed on this page and their landing pages, and try to convince yourself that you — as the potential user — are the intended audience rather than an investor.

But there are still conceivable ways to dig us out of this mess. For instance, we can pin down the terrible externalities of crypto by instituting carbon taxes that will, among other things, disincentivize mining activity since its profitability is inextricably tied to the cost of electricity.

But won’t this just cause miners to relocate to some country that doesn’t have a carbon tax?

Sure, but the cost of shifting mining infrastructure is not cheap, and the margins of crypto mining are not particularly lucrative nowadays. This won’t outright halt emissions from cryptocurrency, but it may cause its inefficiencies to become so apparent that its users reconsider its utility, or at the very least hasten its transition to less polluting mechanisms.

There is a direction that the internet is heading in, which unlike web3, does not need venture backing to sustainably grow or a minority of technocrat zealots to buy into. For better or worse, the actual web3 might be a network of tightening walled gardens and federations. Much of the internet has congealed into pools of user-produced content that are becoming increasingly inaccessible and myopic.

Think of Reddit, Facebook, or Discord communities of thousands of people, whose activities are impossible to index on a search engine. Think of how the web became less navigable with artificial moats like login pages and paywalls, and is now being further entrenched with ideological barriers like echo chambers and content algorithms.

An analogy we can use to express this trend is how our known universe is composed of galaxies that are drifting ever farther from each other, while each galaxy is crunching inward into a more compact form — the internet has created ever-tightening ingroups while separating people at large from each other. I myself know of two big ‘galaxies’ in the form of the Western internet and the Chinese internet, and we are seeing the schism of the alt-right internet taking hideous shape today.

But I digress. At no point of this tectonic shift will a web3 of cryptocurrencies and NFTs have a naturally relevant seat. It will remain tomorrow as it lives on today: a messy dream.

May 2022

Presented by Eric Cheng for 80-445 at Carnegie Mellon University. Opinions expressed are my own and do not necessarily reflect views of any affiliated people or organizations.

No matter if you found reading this enjoyable, or feel as though I got something seriously wrong, I would be glad to talk further.

Thank you to Simon Cullen for reading drafts of this.

Footnotes

According to researchers from the Cambridge Centre for Alternative Finance

According to the Federal Reserve’s Survey of Consumer Finances, American households had a median savings of $5,300 in 2019.

Moxie Marlinspike wrote a good blog post about this topic.

An interesting visualizer on Ethereum’s energy consumption

$499 in the United States as of May 2022

Using the official supported GPU list and their average TDP, we can extrapolate the power requirements of the system at large.

See this Stack Exchange thread on the difference between anonymity and pseudonymity.

Data from this tweet by Will Papper